- 30 Jul 2021

CEO shares the story behind EdgePoint and his ambitions for the new venture

30 Jul 2021

Read this article to learn:

- EdgePoint Infrastructure’s business model and geographic scope

- What EdgePoint needs to do to become a next-gen infraco

- The short history of the company and key milestones over its first nine months

- The team Sidhu has assembled and their responsibilities

- What is EdgePoint’s predictions for the ASEAN region, and where their focus will lie in the immediate future

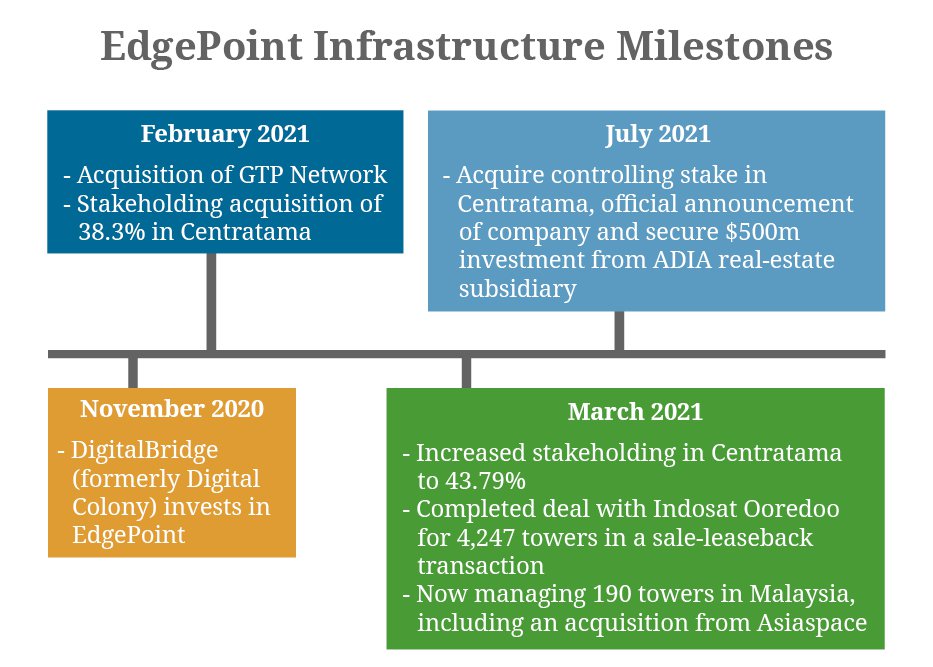

Asia’s newest towerco, EdgePoint Infrastructure (EdgePoint) has the ambition, financial backing and necessary experience to make major waves in the industry. Having begun operations in November 2020 and an official launch in July 2021, the DigitalBridge-backed firm has already secured over 10,000 sites which includes secured M&A and a Build To Suit (BTS) pipeline. Excitingly, they have no plans on slowing down. TowerXchange sat down with Suresh Sidhu, CEO at EdgePoint, to speak with him about the companies origins, its early investments and its pan-Asian ambitions.

TowerXchange: We have been hearing little snippets of information about the formation of EdgePoint Infrastructure over the past few months, with this month signalling the much-anticipated formal announcement of the entity. Can you give us a little bit of background and history on the inception of EdgePoint?

Suresh Sidhu, CEO, EdgePoint Infrastructure: The official date we began operations was November 2020 which was when we closed an agreement to establish the company with Digital Colony (now DigitalBridge). After I had left edotco, I felt there was an opportunity to do something different and create a much more modern infrastructure company a different way.

After building a team of fellow founders, we first secured an initial license for Malaysia early in 2021. Soon after that, in March of 2021, we acquired Asiaspace.

At almost the same time we concluded transactions for a 43.79% stake in PT Centratama Telekomunikasi Indonesia, Tbk (Centratama). This has since grown to a controlling 76.79% stake which was completed on 7th July 2021. Centratama provides us with a portfolio comprising towers, in-buildings, (which is the largest in Indonesia) and also fibre and last mile ISP network infrastructure.

A further major milestone was our sale and lease-back agreement with Indosat Ooredoo which was for 4,247 towers.

TowerXchange: You mentioned wanting to bring something different to the industry. What exactly is that?

Suresh Sidhu, CEO, EdgePoint Infrastructure: The rollout of 5G across ASEAN necessitates towercos to adapt to the new challenges and requirements of their clients. Integrated shared antennas, edge computing and a need for sites to be well integrated with urban landscapes are important for next-generation infrastructure players. I think it’s fair to say that towercos needs a refresh in terms of their product suite and the problem they are trying to solve.

We also have a more open mind towards active infrastructure provision and Open RAN.

Working with DigitalBridge is such a good fit for these ambitions because they are very knowledgeable in a diverse range of businesses in the infrastructure space. They have deep experience managing towers, fibre and small cell and EdgePoint can benefit hugely from that knowledge and skill.

TowerXchange: Can you tell us a little bit more about the management team at EdgePoint?

Suresh Sidhu, CEO, EdgePoint Infrastructure: The team comprises some from the edotco team: namely Carson Wolfer who acts as our Chief Strategy Officer and Manoj Senaratna who was the head of group strategic finance at edotco and is now our VP of Strategic and Corporate Finance. Muniff Kamaruddin left edotco in 2018 and is now our Group CTO & CEO for Malaysia.

Anil Karamsingh acts as an advisor for business development.Chee Wi Lyn plays a big role in the EdgePoint team as our Vice President for Corporate Services and Programme Management. We have also been joined by others with industry experience like Jacopo Rigamonti who previously held commercial roles at Protelindo and Apollo and will now lead this function for EdgePoint. Through Digital Bridge, we get the support of people like Mike Bucey, who was ex-Protelindo.

In addition, we’ve strengthened the executive team at Centratama and have further plans to augment not just our corporate, but also our country teams

TowerXchange: What is EdgePoint’s mission and vision? What targets has the company set itself and where do you see yourselves integrating into the tower market?

Suresh Sidhu, CEO, EdgePoint Infrastructure: Our ambition is to be in the top two infracos/towercos in ASEAN. We think scale matters, but we are conscious we need to balance that with investing capital wisely. So whether that scale will translate into growing into a company that owns and manages 20,000 or 30,000 or even more towers will depend on opportunities. We want to grow as big as sense dictates that we should.

With this philosophy in mind we have refrained from setting specific goals in terms of number of sites, but we do have a mission to be seen as the reference point for the regions the 5G towerco. We want to focus on discrete locations, sites and structures, in-building solutions, towers, poles and microcells – basically any type of telecom infrastructure that needs to be 5G ready. We also want to support this with integrated fibre which will be ready to be deployed for other purposes.

TowerXchange: What is the geographical scope for EdgePoint?

Suresh Sidhu, CEO, EdgePoint Infrastructure: We want to be seen as the next generation infra co for ASEAN. Many of the team here at EdgePoint are natives of ASEAN countries, or at least they have been residents for a long time. We feel we have a high level of local knowledge and due to previous experiences we have good relationships with MNOs across the region.

In ASEAN there are a lot of highly evolved economies and a strong macroeconomic environment. Many of the ASEAN nations have progressed from emerging market status and some of the stronger economies are teetering on the edge of developed status. Importantly, there is a stable foreign exchange environment which really matters to investors and corporations who are looking at the region.

From a more specific telecom infrastructure perspective, there are good, well-regulated markets throughout the region. It’s clear what you can and can’t do which makes things a lot easier to enter and operate in markets. Licencing models are established and clear, they are relatively simple and crucially, they aren’t particularly expensive either! Regulators don’t overly tax entry, and they create an environment that helps make sure that companies invest for the long term.

There are still lots of MNO owned towers and requirements to scale the number of towers in many countries to improve coverage in both rural and urban areas. As a result, it does remain an underserved market from a towerco perspective, so we think EdgePoint can make a big difference.

We also see the ASEAN region as ripe for M&A activity. We expect that 5G rollouts will dictate a need for MNOs to raise capital, so sale and lease-back will become more common. This is a good opportunity for a towerco because many of the operators are confined to a single country, and to create a single country towerco of their own might not be worth it for them.

TowerXchange: Can you tell us more about the companies you’ve acquired? What made their portfolios so appealing?

Suresh Sidhu, CEO, EdgePoint Infrastructure: Let’s start with Centratama. Access to Indonesia was important to us as it’s a market with over 100,000 sites and an ecosystem of mature towercos. We thought that the dynamics meant that entering as a pure greenfield towerco wasn’t really realistic for our growth ambitions. For this reason, we felt that the best opportunity to enter would be through a mid-sized towerco. It was fortunate timing as a reset in Indonesian valuations meant people were happier to sell than they had been for a few years previously, and we were able to move quite fast.

We settled on Centratama because it’s a nimble company that we felt punched above its weight. We needed something scalable and they aren’t just M&A focused, they are co-location and build-to-suit focused as well, so that organic growth was appealing.

We were also able to capitalise on moving quicker than expected with the Indosat sale and leaseback deal. We did expect Indosat to sell their towers but thought it would be a bit later than it was. They brought their own timelines forward and we’d just completed the first Centratama transaction so we were looking for our next move. The opportunity to have a large MNO as a serious anchor customer was very appealing.

In Malaysia we would have loved to start with a scale play, but there isn’t one available. The first thing we did was acquire a small firm called GTP, who were our gateway to becoming a licenced entity. GTP operated 10 sites in Malaysia, so we’ve been able to scale from 10 sites to over 10,000 in less than a year!

We wanted to take contracts with operators and with GTP we could do this. They were a small and robust team that we felt we could build around and grow. We have since completed the Asiaspace deal, and we have a strong M&A and build to suit pipeline in Malaysia, so these ambitions we had of GTP have come to fruition already.

TowerXchange: What is your outlook for Indonesia and Malaysia over the coming years and do you have a third region to enter in mind?

Suresh Sidhu, CEO, EdgePoint Infrastructure: There is a lot of new build activity in Malaysia with up to 1,000 sites a year being built during the peak 4G rollout and we expect this level of growth to continue. Covid has slowed this somewhat but it’s more ‘put things on hold’ than anything else.

The creation of a separate single 5G network in Malaysia is driving the need for new colocations, including new sites. At the same time Malaysia is not finished with its 4G densification and their 3G shut down is in progress as well. Some of the 3G resources will transition to 4G. We also expect urban densification to continue and a significant focus on the west coast.

Indonesia have lifted their restrictions on limited foreign direct investment, which means towercos can now be entirely owned by a foreign stakeholder. We expect this will bring even more dynamism to an already complex market.

In both regions, EdgePoint’s strategy is for both organic and M&A growth. For now, implementing these strategies in Malaysia and Indonesia is our primary focus and there isn’t a specific target for our third market. We will keep our eyes open for a scale entry into a new market when the right opportunity arises, and we might consider the odd green field, as long as it’s a means to a bigger position.

TowerXchange: We haven’t seen many pan-Asian towercos. Why do you think that is and what will EdgePoint do differently?

Suresh Sidhu, CEO, EdgePoint Infrastructure: There are significant difficulties in running a multi-country towerco in Asia. The ASEAN region is united by many things, but there are also just as many things that are unique to each country. I think you can boil it down into a few key issues – firstly there aren’t too many multi-country operators, so getting the right access to assets is less advanced than the regulation that underpins your ability to acquire them.

Getting the right capital structure in place is also a challenge with countries having quite different costs of capital. Many parties also underestimate the investment needed to build a credible multi country business. At EdgePoint we feel we are equipped in this regard. With the support of Digital Bridge, we’ve already deployed over US$1bn and have secured commitments from our investors. We have even more capital available for when we need it, but we are all about doing things at the most logical time.

You also need the right collection of skillsets to build an ASEAN wide towerco by creating a team that is tight, integrated and focused on the right things while maintaining the flexibility to capitalise on opportunities and demands from clients. At EdgePoint we are instilling this culture and building a business that has an open mind commercially and can think ahead on delivery.

TowerXchange: How else will EdgePoint achieve this vision? What does the operational infrastructure look like?

Suresh Sidhu, CEO, EdgePoint Infrastructure: We think of our operational model as one where we create an ecosystem of tightly linked partners. We are keen to establish partnerships wherever they add value to us. Our approach to outsourcing is as simple as saying, are we good at this – or is there someone else that can do it better? For example, we are establishing partnerships on land bank access and looking to use digital tools for predictive coverages. Working in a partnership model rather than having these functions in-house keeps things more fluid and allows us to correct things quicker when they go wrong.

We need to continue and listen a little ahead of the industry to make sure we are responding to the changing needs of customers. If we do this, and are clear about what we need to control and keep the decisions circle tight, we will make a difference.

Power is an example of this as it’s something that towercos in Malaysia and Indonesia have traditionally been less involved in. The requirements depend on what country you are in, and we remain open to providing it in the right circumstances. Net Zero obligations on the MNOs’ behalf could have a big impact on how towercos approach power across the board and this may be something where the towerco plays a role. Shared antennas are another example of the type of conversations we are having. We solve the problem by not compromising our core model, but if you start by saying you can’t do it, you might miss the future.

Our current focus though is to bed down the assets we have bought. One of the first things is we need to digitise and standardise our operations. While we are an asset company, we need to also control the information to help us do what we do best. We have a great team in Centratama for the on-ground operations, but we can add value by creating a more frictionless operating environment using the right platforms and systems.

A key requirement is for us to build an asset management system that acts as a single source of the truth. We are also keen to invest in data and systems to streamline contract management and workflows, and in the future and anything that can enhance the analytics of the business. But we also need to mindful that we are growing company and step one is to develop operational infrastructure that must be scalable.

View source version:

EdgePoint Infrastructure’s Suresh Sidhu: We want to create a modern infrastructure company | TowerXchange

EdgePoint Infrastructure’s Suresh Sidhu: We want to create a modern infrastructure company | TowerXchange

TowerXchange Homepage: https://www.towerxchange.com/